OZ FundHub Connect featuring GTIS Partners

On August 19th, OZ FundHub hosted our first OZFH Connect Multi, a new format for our pitch session webinar that features three different Opportunity...

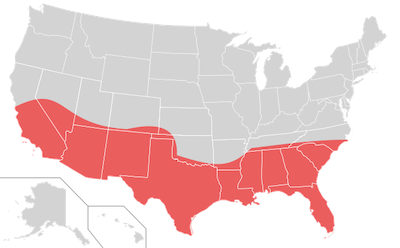

For decades, Americans have been flocking to the warm climate of the southern portion of the US, fondly called the sunbelt. The sunbelt region is loosely defined as the stretch along 18 states in the southern portion of the continental US, from the San Francisco Bay Area to Las Vegas, Dallas, Nashville, Charlotte, Raleigh and the areas south of these hubs. The sunbelt includes 7 of the 10 largest US cities*, and 50% (326 million) of the US population, which is expected to rise to 55% by 2030*. In fact, over the last 10 years, 75% of the total US population growth has occurred in the sunbelt; 15 million of the total 21 million in growth*.

Why the popularity? Historically, the sunbelt has offered residents a low cost of living, a low tax, business friendly environment, and a warm climate to boot. The incredible economic growth and need for new housing and business space to house the growth makes investing in sunbelt Opportunity Zones (OZs) enticing for investors in Qualified Opportunity Funds (QOFs). That is particularly true for the experienced team at GTIS Partners, who is focusing much of their planned OZ development in the sunbelt.

A major contributing factor to the sunbelt’s popularity is the friendly tax structure. With the exception of California, most sunbelt states have low (if any) corporate, individual or property taxes. For these reasons, many businesses and individuals alike are coming from highly taxed states en masse. In turn, the business friendly environment has led to massive private sector growth. Over the past 10 years, employment grew outside of the sunbelt by 9 million jobs, or 12%. In the sunbelt, employment grew by 12 million jobs, a whopping 20%*.

Additionally, the warm climate makes many regions of the sunbelt prime for tourism and retirement. As such, roughly half of the nation’s hospitality and leisure jobs are in the sunbelt*.

Millenials are considered to be late bloomers in the home ownership category. Having largely entered the workforce in the midst of the great recession, many millennials have put off purchasing a home until now. The sunbelt has been particularly enticing for millennials: its estimated that 50% of millennials in the US already live there*. Traditionally, hot spots for this age bracket have included the country’s biggest cities, but high costs of living coupled with a perceived low quality of life have led this population to seek out lives in mid-sized cities instead. Even so, millennials are most densely populated in San Francisco and Los Angeles, but now also in Austin, San Diego and Charleston as well.

As for job opportunities, Clarion Partners estimates that currently about half of the nation’s nonfarm office jobs are located in the sunbelt*. With the millennial population expected to reach 75% of the workforce by 2030* as baby boomers retire, the sunbelt is poised for explosive growth to continue. Already the sunbelt has developed footholds in high tech, energy, health services, media and entertainment. Experts expect to see job growth continue as people move in and investment continues.

As of 2022, many millennials are still renting. Millennial hubs in the sunbelt; Los Angeles, San Jose, Austin, San Diego, Miami and Houston, tend to have high home prices and thus lower rates of home ownership than the rest of the nation: 50-60% vs. 64.8% nationally.* Most of the rest of the sunbelt, with the exception of California and parts of Texas, have relatively low median home values and rental pricing. While many millennials are now looking to purchase homes, both new single family homes and multifamily rental development are well poised for significant investment.

The enormous baby boomer generation is reaching or has reached retirement age. Where do they like to retire? The sunbelt. With this large generation and growing life expectancy, seniors are already 16% of the total US population, and that figure is expected to reach 20% by 2030. Half of the nation’s seniors already call the sunbelt home, with 50% of the purpose-built senior housing being located there: roughly 1 million beds.*

Seniors are already highly concentrated in states like Florida, Nevada and Arizona. However, cities expected to see the most growth in the senior population are Orlando, Austin, Phoenix, Raleigh, Las Vegas, West Palm Beach and Jacksonville. While seniors currently have the highest percentage of home ownership, we are already seeing a move to sell property in favor of downsizing or moving to facilities that cater to senior living. Village-style living facilities are becoming popular, where seniors can live with necessities close at hand and not be dependent on cars for transportation.

Qualified Opportunity Fund GTIS Partners sees tremendous value in Opportunity Zone investment in the sunbelt. Headquartered in New York, GTIS managed $4.7 billion in assets in 2021, closing on $630 million to be invested in residential and industrial real estate. Their inaugural QOF is one of the top 5 largest QOFs raised to date. This fund is focused on large regional sunbelt Opportunity Zone markets in Phoenix, Las Vegas and Charlotte, with a plan to develop ~5,300 residential units with ~1.6 million square feet of commercial real estate space.

GTIS Partners has commitments from over 1,600 individual investors and family offices. On July 1, 2022, they opened their latest offering, Opportunity Zone Fund II. This second fund is structured as a diversified REIT and is open to accredited investors with a minimum investment of $100,000. “We are excited to continue our investment strategy utilizing the tremendous tax benefits of Opportunity Zones. We believe that residential and industrial fundamentals remain attractive especially in an inflationary environment, and look forward to capitalizing on the opportunities we have in our pipeline.” states Tom Shapiro, President and Chief Investment Officer of GTIS Partners.

To date, GTIS has completed 3 development projects in Opportunity Zones with a total project cost of about $460 million. These developments have yielded 566 residential units and more than 630,000 square feet of commercial space to communities in need of new investment. GTIS also has an additional 5 developments in the sunbelt that are currently under construction and will be delivered in the next several months with more than 700 multifamily housing units, 200 single family build-to-rent homes, 430 student housing units and plenty of commercial space.

Are you interested in focusing your Opportunity Zone investment on the high-growth sunbelt? Check out our interactive opportunity zone map now. Or, use our fund finder to be matched with Qualified Opportunity Funds that meet your investment criteria.

*Statistics from Clarion Partner’s Article The Rise of the U.S. Sun Belt

On August 19th, OZ FundHub hosted our first OZFH Connect Multi, a new format for our pitch session webinar that features three different Opportunity...

On paper, New York should serve as a linchpin for the Opportunity Zones program. With a major housing deficiency and 514 Opportunity Zone (OZ)...

.png)

Washington state has been listed among some of the top states within the country for investing in Qualified Opportunity Zones. Based on recent data,...